What Is The Most Commonly Used Base Item For A Common Size Income Statement?

What is the Mutual Size Ratio?

The Common Size Ratio refers to whatsoever number on a business organisation' financial statements that is expressed as a percentage of a base.

Global Common Size Ratios

Global mutual size ratios limited a number on a business concern' financial statement equally a percentage of a denominating relevant number on the statement. Thus, all the percentages shown can be easily interpreted and compared to other line items in the financial statement.

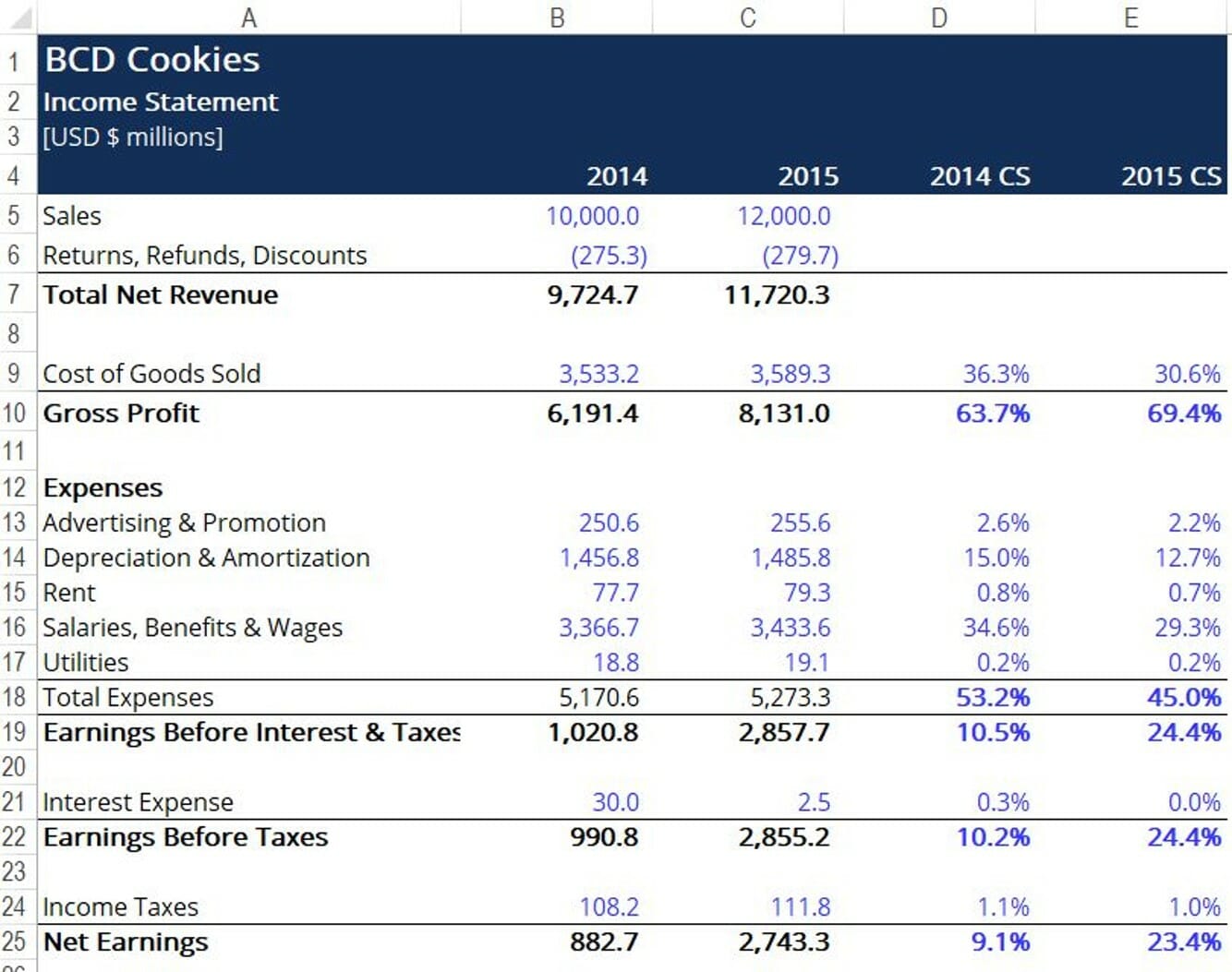

Consider BCD Cookies Ltd, an organization that wants to conduct financial statements analysis. The first step to ameliorate understanding the price breakdown of the enterprise is to convert its statements into the common size format. Take, for example, the income statement – which can be converted to limited a common size ratio by dividing all line items by the acme line revenue. Below is a snippet of what this would await like:

The same methodology can also exist applied to the business' other financial statements in order to get a dissimilar perspective. For the balance sheet , you can focus on the asset department and divide all line items by the business concern' full assets to improve empathise the company. By doing and then, you can examine individual nugget accounts and go a better agreement of their corresponding weights on the balance canvas.

With the cash period statement , you can divide the argument into its 3 parts (financing activities, investing activities, and operating activities). Then compute the relevant common size ratio by dividing the line items by the net cash flow for the specific section of the statement. Conversely, you can have a broader view of the business' greenbacks state of affairs past dividing all line items by the net cash catamenia amount.

Tailored Mutual Size Ratios

Consider again as an instance BCD Cookies, which recently reported a revenue of $5 meg. Jack, the business owner, wants to express the figure as a office of a base of operations. First, he must find a base that is relevant to the analysis that he wants to conduct.

Supposing that Jack wants to gather additional insights near the way that his business costs are laid out, he may use the cost of goods sold (COGS) as a base of operations. Supposing that the business concern posted a COGS of $two million, the common size revenue per COGS would be (v / 2) x 100 = 250%. The number could also be expressed equally a multiple such as 2.5x. Thus, Jack is able to conclude that his revenue is 2.5x the business organization' COGS.

While the common size approach may be useful in conducting fiscal statement analysis, it may sometimes be quite difficult to derive pregnant from the ratios.

Using Mutual Size Ratios

Common size ratios can exist very useful when trying to get a better understanding of a business. Nonetheless, they demand to be examined within a certain context in social club to derive meaningful conclusions.

Common size ratios are most effective when compared across multiple companies that operate in the same industry. This enables you lot to rank companies based on specific metrics. Ratio assay can help with the identification of a business' strengths and weaknesses. That can, in turn, aid in formulating changes to the business organisation' overall strategy.

Common size ratios are also very useful when compared over a sure time menstruum. This enables you to more easily observe trends in specific metrics and, in turn, adapt the business organisation' strategy in order to go far at a more than optimal issue.

When comparing whatsoever two common size ratios, information technology is of import to make sure that they are computed by using the same base of operations effigy. Failure to practice and so will return the comparison meaningless.

Boosted Resources

CFI offers the Financial Modeling & Valuation Analyst (FMVA)™ certification programme for those looking to take their careers to the next level. To proceed learning and advancing your career, the post-obit CFI resources will be helpful:

- Corporate Strategy

- Projecting Balance Canvas Line Items

- Projecting Income Statement Line Items

- Financial Ratios

What Is The Most Commonly Used Base Item For A Common Size Income Statement?,

Source: https://corporatefinanceinstitute.com/resources/knowledge/finance/common-size-ratio/

Posted by: singhsourn1974.blogspot.com

0 Response to "What Is The Most Commonly Used Base Item For A Common Size Income Statement?"

Post a Comment